Difference Between Hurricane, Named Storm, and a Wind/Hail Deductible

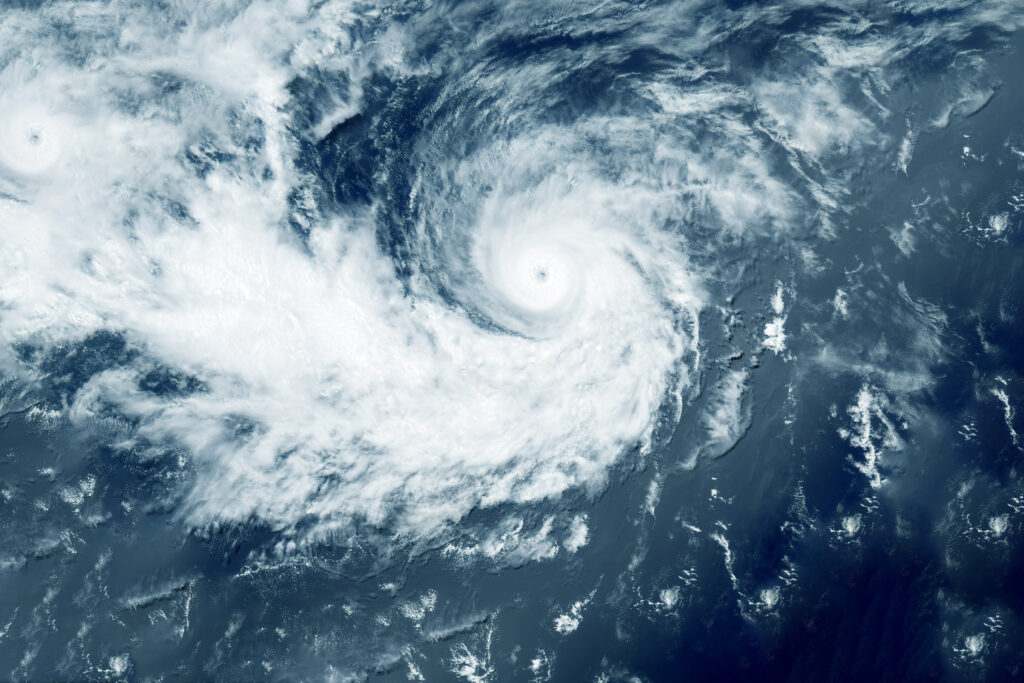

Summer and early fall are popular times for harsh, potentially damaging storms. With hurricane season approaching, it’s important to understand what your homeowner’s insurance policy covers when it comes to severe weather. Staples & Associates can help you understand the difference between a hurricane, a named storm, and a wind/hail deductible.

How to Know Which Deductible Applies to a Severe Storm

Most homeowners’ insurance policies include one of the three deductibles listed below.

Hurricane Deductible

Hurricane Deductible applies to hurricanes only. If the storm is still hurricane strength when it causes damage to your home, this deductible applies. If the storm has been downgraded to a tropical storm when it causes damages, then this deductible does not apply and the All Perils Deductible would be used.

Named Storm Deductible

Named Storm Deductible applies to any storm system that the National Weather Service or another meteorological organization has named. This includes hurricanes, tropical storms, Nor’easters, winter storms, etc. If the storm has been named, this deductible is used.

Wind/Hail Deductible

Wind/Hail Deductible applies to any damage caused by wind or hail regardless of the type of weather event that causes it. Hurricanes, tropical storms, tornados, or a basic thunderstorm, are all treated as wind/hail events.

If you’re unsure what your home insurance policy covers, or want to change it, schedule a meeting with a Staples & Associates agent. Our team is available to help you make the best insurance investments to protect your home or business.

DISCLAIMER: The content provided in this blog is for informational purposes only and is not intended as legal, financial, or insurance advice. While we strive to keep information accurate and up to date, we cannot guarantee that all content will remain current or applicable to your specific situation. Staples & Associates and its affiliates are not licensed claims adjusters and do not make determinations regarding policy coverage, benefits, or exclusions. For questions about your specific insurance policy, claims, or coverage details, please contact your licensed insurance agent directly.